- #US SAVINGS BOND PROGRAM FOR MAC FULL#

- #US SAVINGS BOND PROGRAM FOR MAC SOFTWARE#

- #US SAVINGS BOND PROGRAM FOR MAC SERIES#

- #US SAVINGS BOND PROGRAM FOR MAC FREE#

What happens if H&R Block makes a mistake on my tax return? Is there a less expensive way for an individual to prepare his or her own tax return? Sure. In simple terms, H&R Block charges the rates it does because it performs a legitimate service and the marketplace supports its pricing structure.

#US SAVINGS BOND PROGRAM FOR MAC FREE#

Pros: Robust free edition: H&R Block has the advantage over TurboTax in its Free edition, which allows for more tax situations than TurboTax’s Free edition, including forms for student loan interest deduction and tuition and fee statements. Access to tax pros on demand at an added cost. Free version is an option for more people than competing free versions. Straightforward interface that’s easy to use.

#US SAVINGS BOND PROGRAM FOR MAC SOFTWARE#

Income from bonds issued by state, city, and local governments (municipal bonds, or munis) is generally free from federal taxes.

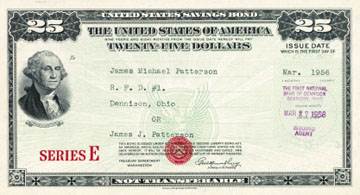

#US SAVINGS BOND PROGRAM FOR MAC SERIES#

For example, if you earned $1,200 in interest on a Series E bond and your tax rate is 28 percent, your tax on the bond is $336, or $1,200 times. Multiply the interest earned on the bond by your federal tax rate. The income from taxable bond funds is generally taxed at the federal and state level at ordinary income tax rates in the year it was earned. The interest generated by bond funds is typically calculated daily, but paid out to investors monthly.

Is bond interest taxed as ordinary income? Also, interest on Series EE and I savings bonds is usually exempt from state and local taxes.

#US SAVINGS BOND PROGRAM FOR MAC FULL#

Backed by the full faith and credit of the United States government, the interest from these bonds is tax-free if used for qualified higher education expenses. Are savings bonds tax exempt for education?Īdvantages. To qualify for this program, the savings bonds must be Series EE or Series I bonds issued after 1989. Which US Savings Bonds are eligible for the education savings bond program? How much does it cost to have H& R Block file your taxes?.What happens if H&R Block makes a mistake on my tax return?.What is the easiest tax software to use?.What is the best tax software for 2020?.Which tax software gets you the biggest refund?.Is it true the less you make the more you get back in taxes?.What percentage of my phone bill can I claim on tax?.Is bond interest taxed as ordinary income?.Is there a penalty for not cashing in matured savings bonds?.Do you get penalized for cashing in savings bonds?.Will I get a 1099 for cashing in savings bonds?.Is interest from EE savings bonds taxable?.Are savings bonds tax exempt for education?.Which US Savings Bonds are eligible for the education savings bond program?.

0 kommentar(er)

0 kommentar(er)